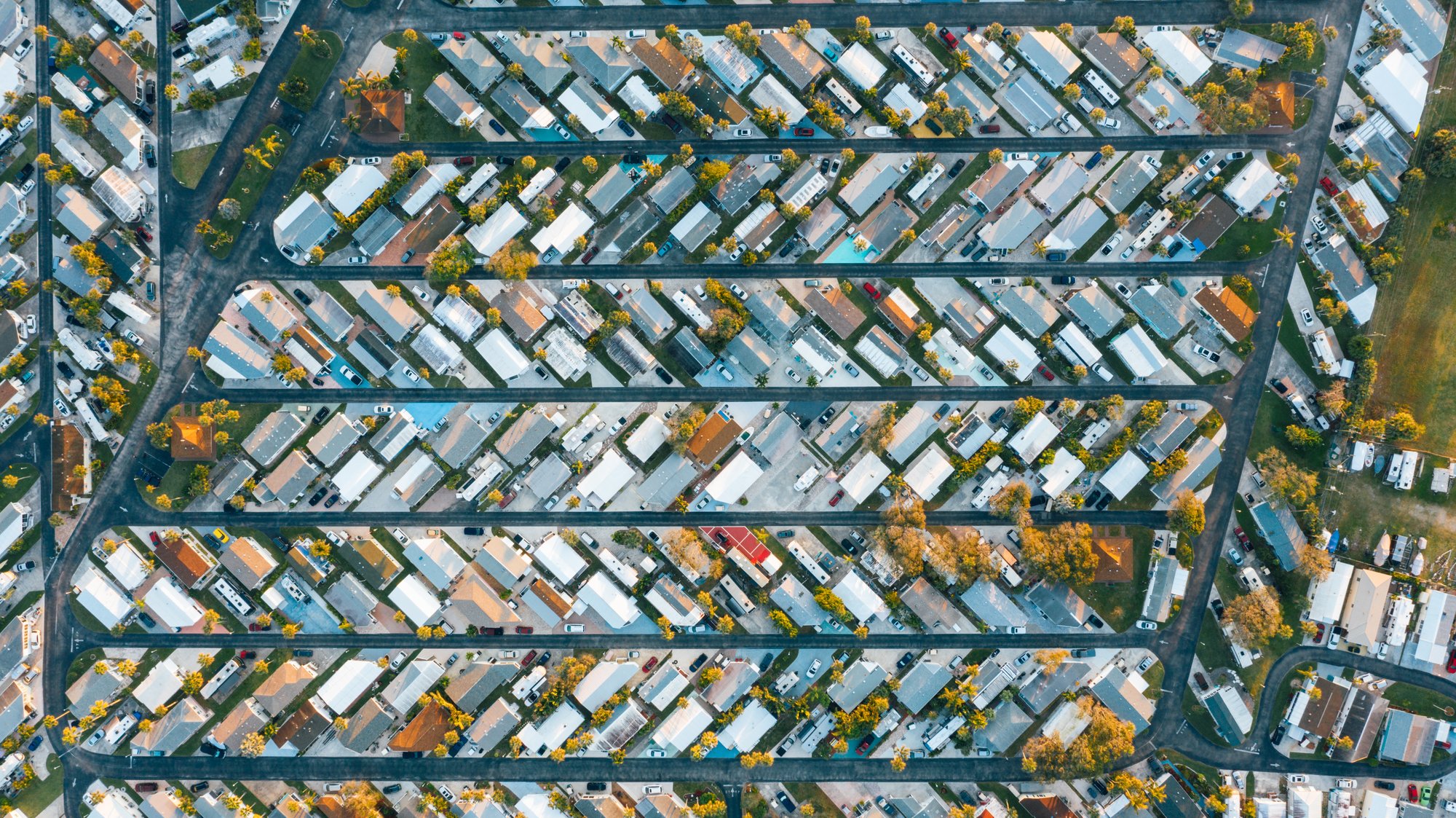

Real Estate Insurance

Insuring your investment property well

When it comes to insuring your SFH, 2-4 unit home, apartment complex, commercial building, or self-storage facility, it's crucial to have tailored solutions specific to YOUR property, not just any property.

Work with industry experts

At our agency, real estate insurance is our top priority. We have an in-depth understanding of buildings, locations, tenant risks, and landlord obligations. While we can't predict the weather, we have the tools and resources to provide comprehensive coverage for your property and liabilities. We don't just focus on insuring buildings superficially; our goal is to safeguard your future rental income, protect your investment portfolio, secure your dream retirement, and provide you with absolute peace of mind.

There is no One-Size-Fits-All

Insurance is a vast and complex world, but our sole focus is on protecting your unique investment. Your policy should be carefully tailored to match the specific needs of your property, including factors such as occupancy, location, and age. Different carriers and programs have their own preferences; some may be eager to insure your building, while others may be more hesitant. Trust the expertise of our brokers who can expertly navigate these waters and secure the perfect policy for you.

We are consistently helping investors in the following ways:

Consolidation

If you are the proud owner of multiple properties, why should you be burdened with the hassle of managing various billing accounts, juggling renewal dates, and keeping track of policy numbers?

Speed that matches you

Are you always ready to seize deals that come your way? Does your insurance keep up with the pace you need?

Billing nightmares

Tired of dealing with the constant headaches of billing? Look no further. Our team has unparalleled expertise in navigating the intricate world of investment property billing.

Does your policy include?

-

Personal Injury

To protect against claims of wrongful eviction, discrimination, or other legal issues brought forth by tenants, it is crucial for your policy to include landlord professional liability coverage, also known as E&O or personal injury insurance. Although there may be no physical harm or property damage involved, the costs associated with pain and suffering claims can quickly escalate in a court of law.

-

Business Income

Would your insurance policy cover your monthly rental income if a storm caused your tenants to be displaced and repairs to be made on your building?

-

Water/Sewer Back-Up

Water can be quite tricky, as any underwriter will attest to. However, rest assured that you can safeguard yourself against the inconvenience of water backing up from a sewer or septic line.

-

Ordinance & Law Coverage

Ordinance and Law Coverage is particularly crucial for older buildings that have undergone numerous code updates over the decades since their initial construction.

-

Equipment Breakdown

Protect your mechanical components from the devastating effects of power surges that can not only ruin your systems but also deplete your emergency fund. Safeguard against these risks with Equipment Breakdown, ensuring peace of mind and financial security.

-

The Right Deductible

Finding the perfect deductible is a delicate balance. While a low deductible may provide a sense of security, a high deductible can have devastating consequences. It all comes down to your risk tolerance and financial capabilities. What was once the right deductible may no longer hold true.

Your investment needs our undivided attention, so that you can focus on what you do best: investing.

Reach out today to begin the best risk management plan you've ever had.